Dawson County Property Tax Rate . the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. learn about the types, rates, and exemptions of taxes in dawson county, georgia. — mail to our office at dawson county tax assessors, 25 justice way, ste. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. By viewing the web pages at the local government services division's website,. the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the.

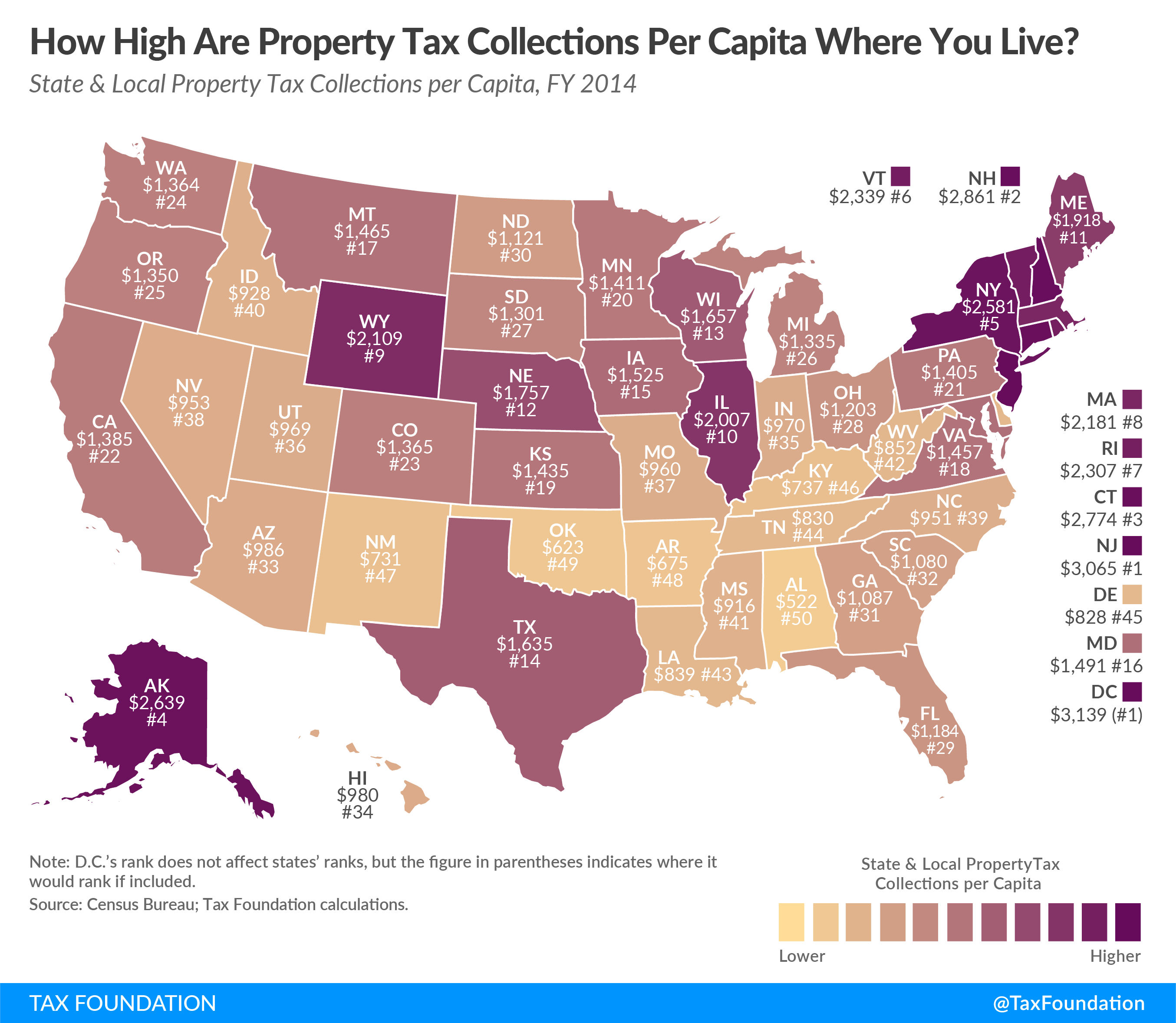

from taxfoundation.org

while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the. — mail to our office at dawson county tax assessors, 25 justice way, ste. the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. learn about the types, rates, and exemptions of taxes in dawson county, georgia. By viewing the web pages at the local government services division's website,. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given.

How High Are Property Tax Collections Where You Live? Tax Foundation

Dawson County Property Tax Rate — mail to our office at dawson county tax assessors, 25 justice way, ste. the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. By viewing the web pages at the local government services division's website,. while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the. learn about the types, rates, and exemptions of taxes in dawson county, georgia. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. — mail to our office at dawson county tax assessors, 25 justice way, ste.

From showmeinstitute.org

Map of Commercial Property Tax Surcharges in Missouri Show Me Institute Dawson County Property Tax Rate the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. By viewing the web pages at the local government services division's website,. learn about the types, rates, and exemptions of taxes in dawson county, georgia. the median property tax (also known as real estate tax). Dawson County Property Tax Rate.

From exobrbkfr.blob.core.windows.net

Dawson County Land Lot Map at Jordan Bryant blog Dawson County Property Tax Rate By viewing the web pages at the local government services division's website,. the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. . Dawson County Property Tax Rate.

From www.madisondailyleader.com

Everything you need to know about the optout Local News Dawson County Property Tax Rate learn about the types, rates, and exemptions of taxes in dawson county, georgia. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given.. Dawson County Property Tax Rate.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Dawson County Property Tax Rate — mail to our office at dawson county tax assessors, 25 justice way, ste. learn about the types, rates, and exemptions of taxes in dawson county, georgia. By viewing the web pages at the local government services division's website,. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based. Dawson County Property Tax Rate.

From www.rentappeal.com

Dawson County Property Management, Dawson County Property Managers Dawson County Property Tax Rate By viewing the web pages at the local government services division's website,. — mail to our office at dawson county tax assessors, 25 justice way, ste. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. the median property tax (also known as real estate tax). Dawson County Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Dawson County Property Tax Rate the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. learn about the types, rates, and exemptions of taxes in dawson county, georgia. while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you. Dawson County Property Tax Rate.

From classcampusenrique.z19.web.core.windows.net

Information On Property Taxes Dawson County Property Tax Rate the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. learn about the types, rates, and exemptions of taxes in dawson county, georgia. . Dawson County Property Tax Rate.

From activerain.com

2019 Property Tax Rates Mecklenburg And Union Counties Dawson County Property Tax Rate By viewing the web pages at the local government services division's website,. learn about the types, rates, and exemptions of taxes in dawson county, georgia. while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the. the median property tax (also known. Dawson County Property Tax Rate.

From www.luxuryrealestatemaui.com

Maui Property Taxes Fiscal Year 2023 Tax Rates Dawson County Property Tax Rate the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. — mail to our office at dawson county tax assessors, 25 justice way, ste. while the exact property tax rate you will pay will vary by county and is set by the local property. Dawson County Property Tax Rate.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Dawson County Property Tax Rate learn about the types, rates, and exemptions of taxes in dawson county, georgia. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value.. Dawson County Property Tax Rate.

From www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities Dawson County Property Tax Rate the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the. — mail to our office at dawson county tax. Dawson County Property Tax Rate.

From laderdriver.weebly.com

Federal tax lien on foreclosed property laderdriver Dawson County Property Tax Rate the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. the fair market value will be determined by the tax assessor's office. Dawson County Property Tax Rate.

From americantaxsavings.com

News American Tax Savings Dawson County Property Tax Rate while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the. learn about the types, rates, and exemptions of taxes in dawson county, georgia. — mail to our office at dawson county tax assessors, 25 justice way, ste. By viewing the web. Dawson County Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Dawson County Property Tax Rate the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. — mail to our office at dawson county tax assessors, 25 justice way, ste. while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor,. Dawson County Property Tax Rate.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Dawson County Property Tax Rate learn about the types, rates, and exemptions of taxes in dawson county, georgia. the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given. . Dawson County Property Tax Rate.

From www.researchgate.net

County property tax rates within study area. Download Scientific Diagram Dawson County Property Tax Rate learn about the types, rates, and exemptions of taxes in dawson county, georgia. the median property tax (also known as real estate tax) in dawson county is $1,430.00 per year, based on a median home value. the fair market value will be determined by the tax assessor's office and the property owner will be notified and given.. Dawson County Property Tax Rate.

From exogkkgyw.blob.core.windows.net

Property Tax Rate Missouri City Texas at Marjorie Hauser blog Dawson County Property Tax Rate while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the. — mail to our office at dawson county tax assessors, 25 justice way, ste. the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed. Dawson County Property Tax Rate.

From dxotsgkpj.blob.core.windows.net

Property Tax Rates By County In South Dakota at Sandra Johnson blog Dawson County Property Tax Rate the mission of the tax commissioner's office is to bill, collect, and disburse all taxes as prescribed by the laws of the. — mail to our office at dawson county tax assessors, 25 justice way, ste. learn about the types, rates, and exemptions of taxes in dawson county, georgia. the median property tax (also known as. Dawson County Property Tax Rate.